Hey Friends,

Thanks for coming to my newsletter. This one’s about crypto, which is very chic right now as you know. I’m close to a novice on the subject, especially next to at least one of my readers, Adam Shipway, Ethereum sensei, whose patience in fielding my questions and suffering my ignorance knows few bounds. I also had a lot of help from fellow-learner and former newsletter partner Jay Pinho.

My goal below is to argue that the cryptocurrency Tether (USDT)—a “stablecoin” pegged to the US dollar—is 1) a key pillar of current crypto markets, and 2) seemingly vulnerable to sudden, total collapse.

This is reportage, not investment advice. My investment advice is that time is precious. (Speaking of time, the prices listed below are all ‘at the time of writing.’)

Cryptocurrency primer (obligatory)

This will focus on today’s crypto markets, not cryptocurrency or blockchains as phenomena. I plan to follow up someday on the history and politics of crypto, why advocates like it, why critics don’t. For now, some basics:

A public blockchain network allows users to keep secure, shared records without any central administrator. Cryptocurrencies are blockchain networks that allow users to record the ownership and transmission of “digital tokens” created by the network protocol.

Bitcoin, the world’s first crypto network, went live in 2009. Its boosters hailed it as the foundation of a new global economy without banks, brokers, or states overseeing and taking their cuts. Critics argued that cryptocurrency tokens aren’t claims on any real-world asset, and so have no intrinsic value; that blockchain networks were inefficient; that decentralization and anonymity made crypto-assets attractive to criminals; and that most Bitcoin commerce consists of speculative trading.

In the decade since as that debate raged use of Bitcoin, Ethereum, and other major networks exploded. Today, tens of millions of people around the world own cryptocurrency. The value of all outstanding crypto tokens—assuming one could sell them all at current prices—stands at over $2 trillion, according to data site CoinGecko.

Satoshi Nakamoto—the pseudonym used by Bitcoin’s creator or creators—described the network as a “peer-to-peer electronic cash system,” to be used for making payments online without a banks or bank-like intermediary.

To date, that isn’t how most people have used the technology. Transferring crypto tokens is typically slower and more expensive than mainstream forms of “digital cash,” which for people in the West means services like Venmo, Paypal, and Wise. Transferring money on those apps cost almost nothing and take almost no time, at least for transfers between users in the same country.

Meanwhile, the average Bitcoin transaction costs almost $3 today and hit much as $60 this past April, according to data site Bitinfocharts. Bitcoin transactions can take anywhere from a couple of minutes to half an hour.

The bigger problem for crypto-as-cash though is price volatility. The prices of bitcoin and other tokens tend to move a lot. They move up a lot; sometimes they move down a lot; often very quickly. Over the last year, the price of a bitcoin rose from around $10,000 to over $65,000, then fell to $30,000 and then rose to $50,000 and has since fallen back somewhat to $43,300.

That’s fine as far as it goes, but it’s not how one wants a transactional currency to behave. Imagine you sell a car for $20,000 worth of tokens. Then, before your buyer’s out of the driveway, prices shift and now the tokens she paid you are only worth $18,500. Or, you get lucky and they’re worth $21,500. But, why gamble when you can just price the car in dollars?

(When real-life carmaker Tesla promised it would accept bitcoin as payment this year, the company included terms guaranteeing it couldn’t be on the losing side of the above situation.)

No.—As it stands today, people trading cash for crypto are mostly doing it for the sake of investment, either to “HODL” for the long-run, or because they’d like to trade the market.

Cryptocurrency exchanges

Would-be crypto buyers have many options. They can buy from Bitcoin ATMs, from local cash-for-crypto sellers, sometimes they can buy it via private banking services, if they can get them. But, the typical way is to buy is though online cryptocurrency exchanges such as Binance, Coinbase, Kraken, Gemini, Huobi, Okex, Bitfinex, FTX, or one of more than 400 others.

Crypto exchanges offer mobile apps and websites much like those of traditional brokerages. Users are able to create accounts, transfer in money from their bank and trade hundreds of tokens twenty-four hours a day. On some exchanges, users can also lend their tokens and borrow against them, buy and sell derivative contracts, bet in prediction markets, trade non-fungible tokens (NFTs)—all kinds of things.

In traditional markets, activities much like these are strictly regulated. But, not so on the exchanges, which currently exist in a legal gray zone. Among major exchanges, there are two patterns. One is exemplified by Coinbase, Kraken, and Gemini, exchanges that incorporated in large jurisdictions, welcomed a degree of regulation and voluntarily limited their offerings.

There are also the more adventuresome exchanges, led by Binance, the largest exchange by far, based in the Cayman Islands, or maybe Malta, or nowhere/everywhere. These specialize in riskier, more exotic products and in minimizing users’ contact with the regulatory state.

There’s a third group as well, decentralized exchanges (DEXs) such as Uniswap, that are even harder to pin down. Uniswap is a protocol on the blockchain itself. There’s a team of developers, Uniswap Labs, but the exchange is just a shared base of code with no owner or headquarters.

On all these exchanges, one is likely to find the same dominant tokens: Bitcoin, the old salt; Eth, native token of the Ethereum chain, designed to be programmable, allowing for cryptographic applications beyond sending and receiving tokens, including the whole panoply of “decentralized finance” (DeFi), NFTs, DEX’s, chain-coded quasi-corporate structures called Decentralized Autonomous Organizations (DAOs), and much else that I won’t go into.

And others. Dogecoin is famous largely thanks to Elon Musk. You may know Ripple (XRP) from the SEC lawsuit against its developers, Ripple Labs. You probably don’t know Solana, Cardano, Litecoin, Bitcoin Cash, Ethereum Classic, Polka Dot, Tron, Chainlink, EOS, Avalanche, and on and on. (I could have included fake ones to make a point, but I value your trust too much.)

What distinguishes each of these, I’m not well equipped to discuss. What I know is that they excite people. But none of that for us. Our subject is boring tokens, so boring they’re made to be boring.

Tether as crypto infrastructure

Stablecoins are blockchain tokens designed to maintain the same price as another asset, often the US dollar. They never go ‘to the moon,’ or, ideally, anywhere at all. Nonetheless, over 60 of them currently trade on exchanges, according to CoinGecko, pegged to a variety of assets (USD, EUR, gold, bitcoin) and maintaining their pegs in a variety of ways: using asset reserves, software algorithms, market mechanisms or some combination.

We’ll focus on one: Tether (USDT), the world’s first stablecoin, launched in 2014. Tether accounts for over half of total stablecoin value and nearly all stablecoin trade volume. Tether is, in fact, the most heavily-traded crypto token, regularly exceeding the trade volumes of bitcoin and eth combined, despite those tokens having far greater overall market value. Since 2019, as many as 60% of all bitcoin purchases were made with Tether, according to research firm NYDIG.

Tether is what’s known as a “reserve-backed” stablecoin. Its tokens aren’t created programmatically, according to strict rules, the way bitcoin and eth tokens are. Instead, Tether’s supply is controlled by a company, Tether Limited, the sister organization of one of the large exchanges, Bitfinex, based in Hong Kong, or maybe the British Virgin Islands.

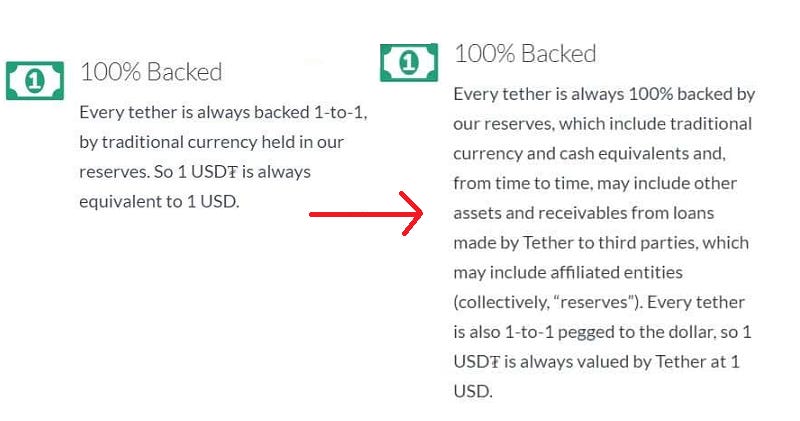

As originally conceived, Tether creation worked like this: The company, Tether Ltd received dollars from buyers, and minted new Tether tokens for them in exchange to take to markets. Tether Ltd promised to redeem the tokens on request for US dollars. To back that promise, the company would hold the dollars it received in a transparent reserve fund.

It doesn’t work like this now. It’s not clear exactly how it works. I’ll come back to this, because it’s important.

Tether is so heavily traded because it fills a gap in crypto markets, the one in the name: stablecoins are supposed to have stable prices. The dollar value of your Tethers doesn’t change in transit, or while you’re sleeping, or in theory any other time. It still isn’t quite “digital cash,” having the same speed and cost constraints as other blockchain tokens. But for users transferring crypto, especially in large amounts, especially across borders, stablecoins clearly offer a benefit. Major trading operations, such as Alameda Research and Cumberland DRW, use them for just this purpose, as do exchanges themselves, along with big-time money launderers, and various other crypto “whales.”

For the punters trading on exchanges, Tether and other stablecoins can take the place of cash or money market fund shares; a way to store funds for future trading or withdrawal. Tether tokens are the most common collateral used to secure cryptocurrency loans. On Binance and other exchanges, traders can use Tether to buy and sell leveraged bets on the future prices of other cryptocurrencies, a market five times the size of token markets themselves, according to researchers at Carnegie-Mellon University.

You might be asking: If acting like cash is so useful, why aren’t traders just using cash? Well, imaginary questioner, they are on the more vanilla exchanges. But on the rocky road/mixed berry ones, including Binance, it’s not an option. That’s because those exchanges aren’t participants in the US dollar banking system and so are to some degree shielded from US-led global regulatory authority. Living outside the law this way has its appeal to exchanges and users alike, but that’s the bargain. Users can often buy in using US dollars, but they can’t actually trade dollars for other tokens on the platform. What they can trade is Tether.

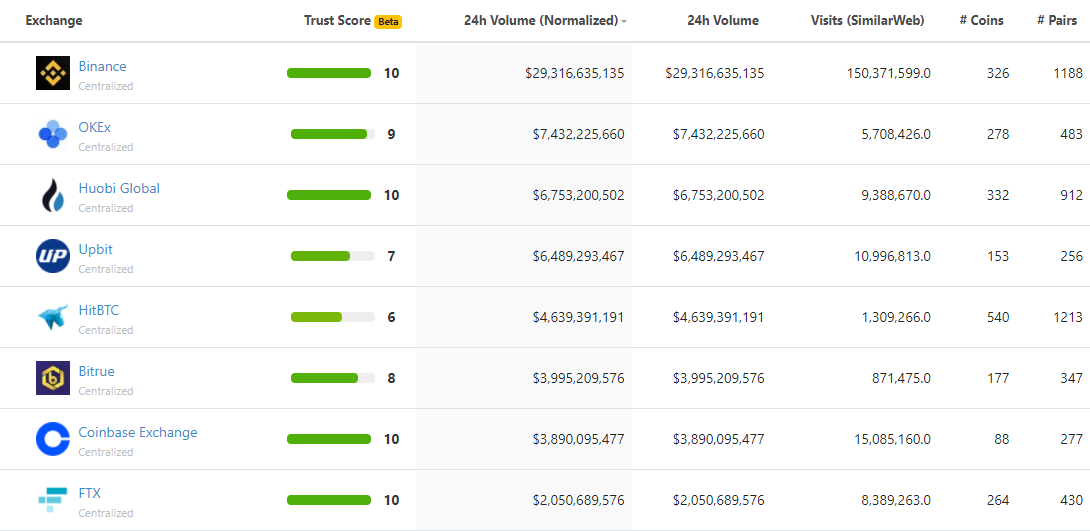

We aren’t talking about pikers either. The five largest exchanges by volume don’t offer USD trading at the time of writing, according to CoinGecko. The sixth largest exchange, Coinbase, refused to list Tether for years for reasons I’ll get to below, until the US-based exchange changed its policy this past May.

Zooming way out for a moment: The US dollar is the world’s reserve currency and the unit of account for global trade. It’s endlessly liquid and accepted nearly everywhere. Tether, USD Coin, DAI and most of the other large stablecoins are pegged to US dollars for that reason. The twist is, on crypto exchanges, the role of the US dollar is played Tether.

Bitfinex and Tether Ltd

Cryptocurrency advocates tout the blockchain’s decentralization, its “trustless,” hard-coded nature. Yet, here we have a significant piece of infrastructure, as I see it, controlled by a private, offshore entity that also happens to be active in trading markets. (Bitfinex executives denied for years that they were also operating Tether until the Paradise Papers on offshore entities exposed them.)

How that reflects on crypto broadly, I leave for another day. The fact is, crypto traders do trust Tether Ltd. The proof of the pudding is in the eating, and they’re eating it in vast quantities. But is Tether Ltd worthy of trust? Consider:

Bitfinex-Tether’s executives and the companies themselves are reportedly targets of a Department of Justice investigation into alleged bank fraud, according to Bloomberg News. The company settled a lawsuit last year brought by the New York Attorney General, promising to pay $18.5 million and to refrain from offering services in the State of New York.

Laticia James, the AG, wrote in a statement:

“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.”

The company’s executive team—several of whom have backgrounds in small-time fraud and ponzi scheming—covered up multiple episodes in 2015-2017 in which the Tether reserve was either substantially drawn down or inaccessible. To give you a sense of it:

Tether/Bitfinex had no functioning banking relationships from March to September 2017. The two companies coped by commingling their accounts with those of their customers, then commingling the two sister companies’ accounts, then entrusting $850 million from that pile to an unlicensed Panama-based payments processor, Crypto Capital Corp, without signing a contract. As it happened, the DOJ working with international partners picked that moment to freeze several of Crypto Capital’s accounts as part of a money laundering and bank fraud case against Crypto Capital and its owner, Reggie Fowler, formerly an owner of the Minnesota Vikings football team. Fowler allegedly strung Tether/Bitfinex along for months refusing to admit the money was gone.

During the period Tether couldn’t access its reserve, the company issued hundreds of millions of dollars in tokens. It’s not clear how clients paid for those tokens. That moment in mid-2017 marked the start of bitcoin’s first rocketship rally, when its dollar price moved from just over $1,000 a token in March 2017 to around $4,450 in September, peaking at a little over $20,000 in December.

From that time onward, Tether’s critics—prominently, the pseudonymous gadfly @Bitfinexed—have accused the company of keeping its business afloat by creating “unbacked” tokens resulting in the injection of fake value into crypto markets and propping up the prices of major tokens.

The New York AG’s Office investigated this charge, but didn’t address it in its final report, which the company claimed as vindication. The charge of price manipulation is also at the center of a ongoing lawsuit brought by five New York investors claiming damages again Bitfinex/Tether from the 2018 crypto collapse.

Tether’s Reserves

Tether’s backing remains a mystery today. The company no longer promises one-to-one cash collateral for all tokens, or rigorous transparency, or unconditional US dollar redemptions. Tether’s reserve fund hasn’t ever been audited in the seven years of its existence, despite the company promising many times to allow one. Tether Ltd did actually engage an auditor in 2017, but then, halfway, fired them, citing the auditor’s “excruciatingly detailed procedures.”

Tether Ltd last month released an attestation of its reserve fund as a condition of its settlement with the New York AG, a kind of one-day snapshot of its accounts without a thorough look ‘under the hood.’ The company has a history of gaming such attestations, according to the AG, transferring money into the accounts in question the morning of the snapshot, then transferring it out again. But, this attestation, the AG hasn’t disputed, so we proceed.

According to that document, Tether Ltd holds about a third of the token’s then-$64.5 billion reserve in cash and US Treasury bills, up from about 6% in their previous attestation a few months back.

The largest share of the reserve’s holdings, accounting for roughly 50%, was in short-term loans to other companies, so-called commercial paper. Tether Ltd piled up enough of this paper to make it the seventh largest holder in the world as of the attestation.

What makes it odd is that Tether Ltd won’t say who the fund is lending to, which isn’t how this typically works. Reporters at the Financial Times asked around Wall Street among people who trade this paper and none had ever heard of Tether.

In an interview with CNBC, Tether executives said the fund’s holdings included Chinese company debt. They also alluded to banking partners acting as so-called “straw buyers” on the reserve fund’s behalf. It’s also possible the attestation is leaving out important information that an audit would include. For now, only the company, its borrowers, and the NY AG have the inside story, and none of them are telling.

The risk here is that if there were ever a run on Tether tokens, the company might not have enough liquid reserves to pay out redemptions. In the textbook scenario, all existing Tether would then be repriced downward, along with the lending and derivatives contracts they’re underwriting. That would in turn cause a wave of further panic accelerating the run.

This is complicated in practice by the fact that Tether Ltd only issues tokens to a few dozen or so whale customers. Everyone else buys and sells their Tethers on exchanges, most of which, including Bitfinex, are centralized and have the power to freeze Tether trading during a run. How that would play out, whether the exchanges would halt a run, whether stakeholders would try to prop up the peg, is for now a purely speculative question.

And now a word from the regulator

These sorts of runs have happened before, including recently. That’s how consumer finance came to be so heavily regulated, why there are rules for “safe” reserves, why banks and brokers face adversarial audits, why the system as a whole is backed by the bailout authorities of the US Congress and the Federal Reserve.

Cryptocurrencies and crypto exchanges either aren’t regulated at all, or, as with Coinbase, they’re regulated according to the lighter standards applicable to payment processors such as Paypal.

But that’s set to change. In recent months, a who’s-who of financial watchdogs have spoken up specifically on the subject of stablecoins, and in a few cases Tether in particular: Treasury Secretary Janet Yellen, Federal Reserve Chair Jay Powell, Securities and Exchange Commission Chair Gary Gensler (who taught a course on crypto at MIT), Senator Elizabeth Warren, along with analysts at Fitch and JP Morgan.

All of them highlighted the risk to crypto holders should stablecoins ever break their pegs, as described above. But, the regulators in the group warned of other risks, not from crypto prices collapsing, but from them continuing to rocket higher.

Today, the crypto token market is worth just over $2 trillion, certainly a lot for “digital money” that didn’t exist 20 years ago. But still, it’s only about half a percent of global wealth, measured at roughly $435 trillion by the Boston Consulting Group.

The bigger crypto’s market value grows, the greater the possibility that a sudden crash in crypto trading markets sparks financial contagion in the way the collapse of the Reserve Primary fund did in 2008.

What steps regulators and Congress take, only time will tell. But, a rough program emerges from a study of the above statements, especially Gensler’s, and from a look at the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act, introduced in the US Congress last December by a trio of left-leaning Democrats.—“Tethering.” See?

Here’s the two-step plan as I understand it:

1) Apply existing regulations. The Commodity Futures Trading Boards (CFTC) would monitor tokens it deemed to be analogous to commodities like soybeans and copper. The SEC would monitor tokens it deemed to be securities, following a legal standard known as the Howey Test: A security is 1) an investment of money 2) in a common enterprise 3) with the expectation of profit 4) to be derived from the effort of others.

Gensler recently suggested to New York Magazine that he might believe that all crypto tokens qualify as securities. At the least, he told a US Senate Committee last week, “the probability is quite remote that, with 50, 100, or 1,000 tokens, any given platform has zero securities.”

Existing rules require issuers of securities to register them with the SEC, publish prospectuses, disclose their reserves, undergo audits and all the standard jazz. Exchanges must also register and are prohibited from listing unregistered securities.

The STABLE Act in Congress would require stablecoin issuers to hold a bank charter—that is, to be a bank—which means even more stringent regulation than that faced by securities issuers. If stablecoins were instead treated as comparable to money market funds, a frequently-made analogy, issuers would be required to follow reserve requirements, disclose holdings, implement anti-money laundering rules, and much else.

2) Central Bank Digital Currencies (CBDCs) are “stable” blockchain tokens issued and guaranteed by national currency authorities. The People’s Bank of China is currently testing a digital yuan, and counterparts in the US and the EU are studying and making preparations.

CBDCs live on blockchains, but they aren’t cryptocurrencies. Central bank tokens are centralized, censorable, surveillable; everything anonymous, peer-to-peer crypto networks are meant to resist.

But, they’d be “stable” to the maximum possible degree. And, they’d be legal. That might be enough for the large financial institutions moving into crypto, for the benefit of which these regulations seem to be written. Cypherpunks these institutions are not. Complying with regulators and using state-backed money are acts they take every day.

Spinning out from the above points, we imagine a sanitized, regulated crypto trading market mixed into the existing brokerage business, using CBDCs or bank stablecoins as cash. Alongside that, we imagine the noncompliant exchanges and tokens based in friendly jurisdictions or offshore, defying international legal standards, allergic to CBDCs.

What role would Tether play in that world? Could today’s Tether-powered trading markets survive in it? These are questions too speculative even for my speculative soul, not to mention we’re already 3,500 words in.

I have this one prediction: we’ll find out, potentially in the next few months—unless Tether and its executives are charged with a crime first.

Further reading:

Bennett Tomlin — The most knowledgeable and scrupulous researcher into all things Tether and Bitfinex. (Crypto Critic’s Corner podcast with Cas Piancey) (site) (twitter)

Schrodinger’s Coin by the hedge funder and podcaster Grant Williams is the best single narrative I’ve found

Youtuber Coffeezilla, who investigates scams, made a good video.

For press coverage, The Financial Times and Bloomberg.

Excellent work, thanks